From the Coast to the Course and everything in between, we’ve got your real estate, design and lifestyle needs covered. Follow along with us here to see how we’re redefining what home means.

#coasttocourse

From the Coast to the Course and everything in between, we’ve got your real estate, design and lifestyle needs covered. Follow along with us here to see how we’re redefining what home means.

#coasttocourse

Beach House Design Details

It’s always fun to see a project through from conception to installation. Our vision for a space usually includes every last detail down to the color of coffee pot! For our Florida beach house we wanted light & airy, fun and not too expensive (since it’s a vacation rental)! Linking some of our favorite finds for the space in this article!

We always like to mix in a few vintage pieces, preferably ones that have a special meaning behind them? Doing so helps a space feel personalized and more authentic. In the kitchen we were able to incorporate a vintage palm tree candle holder from Jason’s Tommy Bahama loving stepdad, and believe it or not I was able to find another set here on Etsy! We sourced a handmade Florida flag and framed it in a glass enclosure and we topped off the decor with a cute woodsy American flag from a local artisan.

Lastly, we like to breath life into our spaces with some greenery. Since we are a short term rental it can be a little more challenging to keep plants alive. Our go to for affordable plants is Trader Joes, we also like to incorporate some dried moss and good faux succulents! Hope you find our beach home as relaxing as we do! Check out our Jax Beach Bungalow for a stay here!

Florida Lighting

For our most recent vacation rental home we wanted to go high style without breaking the bank! Located just a few steps to the shores of the Atlantic Beach our goal was an approachable style that elevated the home while still feeling laidback. This west coast girl is TOTALLY against ceiling fans BUT everyone said they were a MUST for the Florida heat so each room has our goto affordable Merwry Fan.

The home is a small 1950s bungalow with an open concept main living space and we teetered back and forth on ceiling lighting. Ultimately we needed up with the Merwry Ceiling Fan in the living room, the Davida Large Pendant over the dining over table, forwent a pendant light over the island in lieu of two Cassidy Wall Sconces in the kitchen. We also installed a show stopping Santorini Floor Lamp that is the perfect corner moment! Warm neutrals with lots of texture kept the room inviting, bright and airy.

We went for an organic style in the bathrooms, featuring an earthy Tumwater Wall Sconce in the hall bath and Astr White Onyx Wall Sconce in the main bathroom. To save space in the bedrooms we used wall mounted plug in sconces. In the main bedroom we used two Leggero Champagne Pole Wall Sconces and in the kids room we’re in love with how these Brass Wall Sconces from SmileLampWorks turned out!

And last but not least our outdoor lighting! The front of the home was a single building plane that needed some dimension. We built a modern wood trellis and complimented it with this oversized Huntersfield 23” Bronze Outdoor Wall Light. Out back we paired these Sag Harbor Bronze Wall Lights with our new deck.

The Best Time to Buy Real Estate in Over 15 Months is Right Now—Here’s Why

Making the move before the market does is the ultimate sign of an investor plugged into their environment. Being able to go against the consensus of “logical” thinking is a difficult task, but soon after, when the market follows, you’ll look like a genius.

So right now, while real estate supply is still historically short, people aren’t buying (because they can’t afford it), and investors don’t want to borrow because they are waiting for rates to drop (and they will very soon), you need to buy. Here’s why.

Interest rates have played the biggest role in the market for over a year now. The Federal Reserve’s attempt at slowing down inflation and the economy and stuffing the record-breaking housing market in 2022 has, for the most part, been a success in their book.

Even though interest rates may have absolutely sideswiped the market, the decently high rates are shaping a new market that can help investors make huge gains down the road.

First, we must look at the sole purpose of raising interest rates in the first place: to slow down the rapid inflation the economy was facing in the first half of 2022. Coming off the hottest real estate market in recent history, where prices were skyrocketing, and buyers could not bid high enough to buy any property that was on the market for more than three days, the Fed needed to get it under control.

Once interest rate spikes started, they continued to rise for over 15 months. The hike has been effective. The rapidly rising home prices of 2022 have slowed down significantly, and homes are not flying off the market like they were a year ago. In fact, according to data from the National Association of Realtors, existing home sales were down 16.6% from last year in July—in other words, the market has sufficiently slowed down.

The Fed is satisfied with its job, so we should expect interest rates to be cut soon. In fact, it’s widely expected the Fed will cut interest rates in 2024.

Related: The Federal Reserve is Suddenly Doubling Its Forecast For Growth—But Will They Keep Hiking Rates?

Cutting interest rates will free up the market, boost the economy, and allow many people to sell and buy their homes more easily. But you should buy before this happens.

It may seem contradictory to accept the current higher rates and buy, only to sit and watch the rates fall for everyone else as they jump into the market all at once. But that’s exactly what you must do to win big right now.

We are on the back end of the interest rate trend, which is now on the clock. That means that interest rates probably won’t go up anymore, meaning prices will drop only slightly more between now and the end of the year. Once rates begin to be cut, demand will increase, and prices will immediately start to skyrocket again. By this time, it will be too late.

Buy now while prices are low. You will be able to refinance as soon as the rates drop, and you will have locked up your assets for a lower price. After refinancing, watch as the market skyrockets again (more modestly this time) and sell when the time is right—instant profit.

But how can we be so sure? First, you must look at the umbrella trends that will have a significant impact on the market behavior over the next 12 months. Understanding where we stand in the market today will help you maximize your success right now and position yourself for more success in the future.

As we approach a presidential election year, history dictates we could see a bolstered economy that would favor the incumbent. It’s happened before in 1984 (Reagan), 1996 (Clinton), and 2012 (Obama). The Biden administration will want the economy to be in a good state as we approach November, and the housing market should be a big factor in this.

Therefore, as we head into the election year of 2024, based on this historical evidence, anticipate the positive outcomes of lower interest rates, decreased construction expenses, and additional advantages.

Macro trends like election years, the economic outlook from the media, and the Fed’s decisions sometimes overshadow the local trends that can help you get more out of your assets as we approach 2024.

The slow season is something to take note of in any market you look to invest in. For many markets, the slow season comes during the winter months. As summer ends, people nationwide begin to settle in for the new school year and the holidays, especially those living in states that experience harsh winters. The heavy snow and freezing temperatures are less enticing for people to move into a new home.

Take advantage of this upcoming slow season by becoming more active as a buyer. Chances are you will get more attention from real estate agents because interest is low. Due to a lack of offers, you may even be able to get a better deal for the sake of the seller wanting to get the burden off of their hands.

Once you dominate the offseason, it’s important to note where you stand in the broader sense of things to position yourself for maximum success in the future.

The real estate market is cyclical, and understanding the four major phases of the cycle is essential for recognizing the current state of the market. The four phases are:

Recovery

Expansion

Hyper-supply

Recession

We currently sit in an expansion phase. Despite what it may feel like right now, if you look at the symptoms of an expansion market, you can see why:

Active new construction: Check

Low vacancy rates: Check

Increased rents: Check

General optimism for the future: Eh

Rising prices: Check

Readily available financing: Check (if you’re willing to accept the rates)

We’re at the end of the expansion phase now. Although you can still navigate the market with an expansive mindset, it would be better to begin positioning yourself for the next phase: hyper-supply.

You can expect a foreclosure wave as properties begin to make their way through the system after being backed up for two years because of pandemic-era protections expiring. Maximize cash on hand to utilize and dominate short sale opportunities before they go up for auction. This is where you can grab huge market share, which may be the start of your fortune as a real estate investor.

The upcoming election, a bolstered economy boosted by interest rates dropping, and the end of a substantial expansion phase in real estate are setting us up for one of the biggest market share grabs in our lifetime.

You have about four months to set up and acquire huge profit margins and get in on the market share in 2024. A seismic shift in the market is on the horizon. Getting ahead of the curve paves the way for success in the years to come.

This fall and winter, act quickly. Anticipate lower interest rates post-calendar flip to 2024 and secure assets at reduced prices that will soar when the Fed makes its move.

Don’t delay. Seize this opportunity before it moves again. Do you want to look back and wish you did, or be glad you took action? Reach out!

Building Our Guest House

The Back Story, we purchased a property in Whitefish, MT on an idyllic 5 acres in May of 2022. The property was a one bedroom, complete fixer, with a detached garage. Here is the how and the why we converted our garage into a luxury two bedroom, 1 bath guest house.

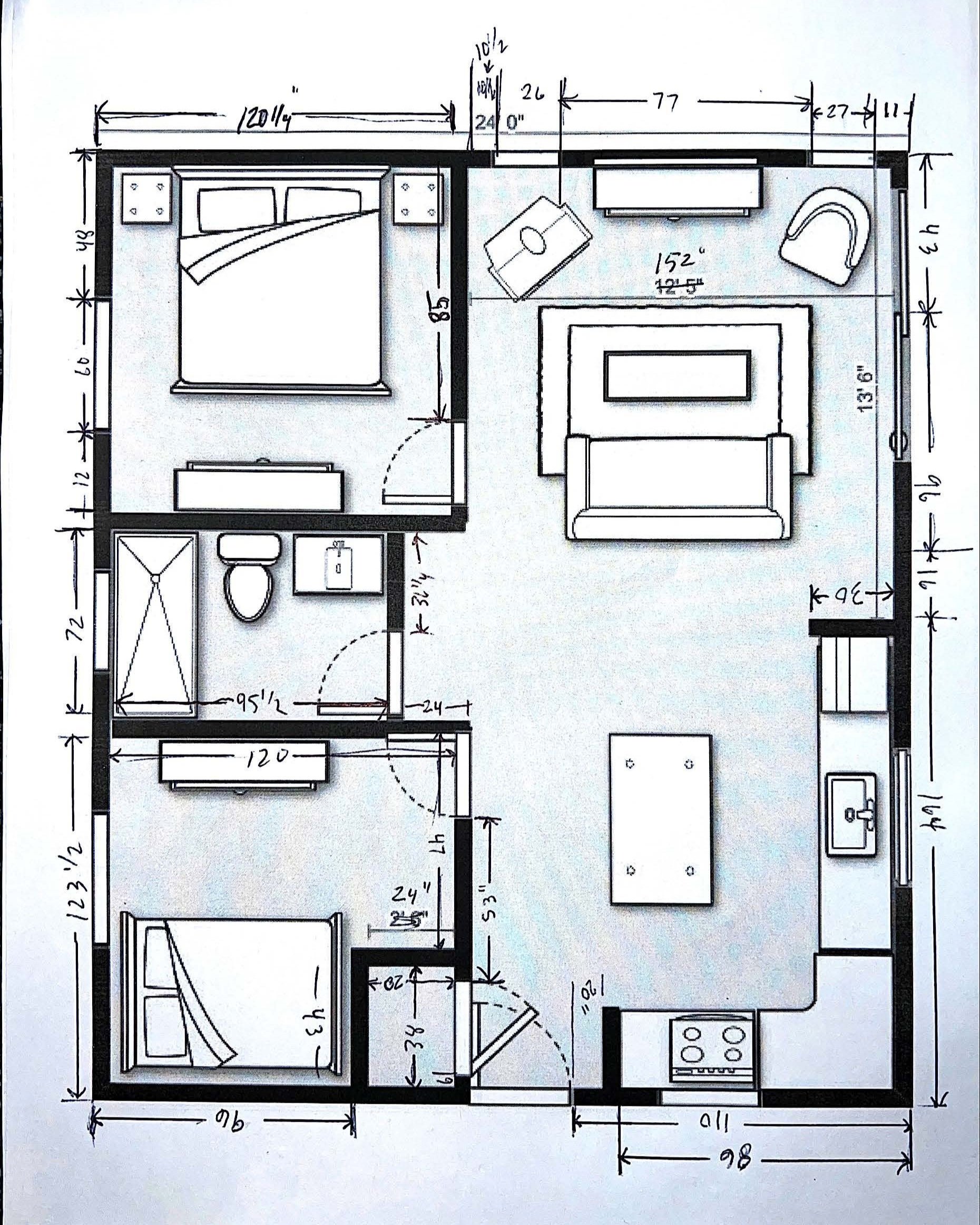

Our garage was a 620 sq ft rectangle shell, initially we were going to make it a one bedroom space so it wouldn’t feel cramped but after turning to AirDNA for actual short term rental data for the area, we found for the 59937 zip code, the most sought after rental size was a 2 bedroom that could sleep a good amount of people. It was then we decided it had to be a two bedroom house.

After multiple revisions we had our layout nailed down (see below). We knew we needed to have full size bunkbeds, a sleeper sofa and an island that doubled as a dining table so that helped informed the layout. Since it will primarily be used as a short term rental, we forwent closets in the bedrooms, this allowed for more living space and a full size kitchen. The biggest hurdles were the utilities, which we ended up sticking in the attic, and a linen closet for our cleaning staff. The big advantage we had were our ten foot ceilings, high ceilings make any small space feel larger! Once we actually got furniture in the space things changed a little, but for the most part everything feels spacious enough and we have room to sleep 6!

From there we had to decide on our finishes (i.e. doors, windows, cabinets, flooring etc). A few factors played into our decision making process for this, we wanted it to match the main house aesthetically, so our cabinet and color palette was somewhat set from there. Being a design forward brand we wanted some standout details and luxury finishes and lastly we turned to AirDNA again to see how much we could charge for a luxury rental. As you can see below, the nightly rates dramatically increase for luxury rental properties in the area so we went for it!

The design features we were most excited about were the moody bedrooms with wood ceilings and our huge wood accent wall in the living room. We wanted to keep the living space bright and open but give it a little character. For a fresh, lived in feel we mixed new furniture with some vintage pieces. And of course we’ve always wanted a black house, so we went dark on the exterior too. Our goal someday is to reside the main house black as well!

If you’re interested in booking one of our Montana vacation homes follow us here!

The Numbers Behind Our Bungalow Addition

The Back Story, we purchased a property in Whitefish, MT on an idyllic 5 acres in May of 2022. The property was a one bedroom, complete fixer, with a detached garage.

When we first started our home search in Montana one of our main criteria was that the property already had an accessory dwelling unit (i.e. a garage, a workshop, etc). We weren’t sure if or when we would utilize an additional living space but we wanted to keep our options open.

The main house of the property we bought in Montana was great but it was an 1,800 sq ft one bedroom home. We were able to convert a large walk-in closet into an additional bedroom but we still felt we would personally like more space. Our initial thoughts were, let’s spend $65,000-$85,000 to create an entire new rental unit (cheaper than buying a new property right!) and it will double as additional space for our enjoyment. Now our budget may have nearly doubled on the project (that’s a story for another time), but we couldn’t be happier with the outcome!

While we may have wanted more space, our decision making process in these types of situations usually comes down to the numbers. We turned to AirDNA to lean on actual short term rental data for the area and here is what we found for Whitefish, Montana:

Now AirDNA has many other features that allowed us to hone in on what attributes perform best in this market and that data helped inform some of our other decisions - like 2 bedrooms and luxury finishes. Using some basic math we crunched these profit numbers, keeping in mind there are lots of costs associated to operating a short term rental.

It will take some time to gain momentum on rental platforms and payback the investment we made to create this rental opportunity, but at the end of the day it will be a profitable investment for us!

If you’re interested in booking one of our Montana vacation homes follow us here!

BRRRR Method of Real Estate

When practicing the BRRRR Method, it’s important to take the following steps in their exact order. Here are a few tips for following each step of the process.

The BRRRR Strategy relies on you purchasing a distressed property in need of updates and repairs, so it may be hard to get a traditional mortgage on the home. There are a few reasons for this. Most lenders require an appraisal on the property, but the value is difficult to assess on this type of property. Depending on the type of loan you get, the property may also need to pass specific guidelines to qualify. A distressed property will most likely not meet those requirements.

Before you rule out financing completely, talk to a lender to see if you do have any options. It may be possible to use a home equity line of credit (HELOC) or a hard money loan to finance the purchase, but these options can be high-risk and are often not recommended.

When buying a distressed property, it’s important to calculate the after-repair value (ARV). ARV is the estimated value of the home after you renovate or rehab the property. To determine ARV, you compare the planned final result of the home to similar homes, or comparables, that have recently sold in the area. These homes should be similar in size, number of bedrooms and bathrooms, age, type of build and condition.

When deciding how much to offer on the home, follow the 70% rule in real estate. Avoid investing more than 70% of the property’s ARV. For example, if a home’s ARV is $300,000, you shouldn’t pay more than $210,000 for the home.

When you rehab a home, the first improvements you’ll need to make are any that will bring the home up to code and ensure it’s safe to live in. Next, you’ll want to identify the types of improvements that will truly increase value. These may include updating the kitchen and bathroom, improving the curb appeal and installing energy-efficient windows, appliances and other features.

Before you start your project, make sure you create a realistic budget and timeline for it.

It’s important to find renters before you refinance (the next step) because lenders generally won’t refinance until a property has tenants.

When it comes to choosing tenants, you’ll want to look for certain qualities:

A good record of on-time payments

A stable job with steady income

A good credit report

No criminal behavior or history of eviction

Positive references

You can find this information by meeting with the potential tenant, having them fill out an application, reviewing their credit report, asking for references and performing a background check. Of course, you’ll want to make sure you get their consent and follow all housing laws.

When determining the rent, it’s important that it’s both fair to your renter and able to produce a positive cash flow for you. You can determine this by subtracting the total expenses to own the home from the total amount of monthly rent you’ll charge. Let’s say you charge $1,500 per month for rent and your mortgage payment is $800. Barring any other expenses, your cash flow is $700 per month. Look at rental rate comparables to help you find the right price.

In the BRRRR method, you do a cash-out refinance on your investment property so you can use the money to purchase another distressed property to flip and rent out. To do this, you’ll need to find a lender that offers a cash-out refinance, and you’ll need to meet the qualifications of the loan.

While the lender may have its own set of requirements, you’ll need to meet a minimum credit score requirement (typically around 620 for a cash-out refinance), a maximum debt-to-income ratio (usually around 50% or less) and have equity in the home. You may also need to own the property for a certain amount of time before you can get a cash-out refinance.

Keep in mind that you’ll also need an appraisal – and there may be additional fees, including closing costs, that you’ll need to pay to do the loan.

In the final step of the BRRRR Method, you’ll go back and repeat the previous steps, in the same order as before. If you want to continue to repeat these steps, it’s a good idea to take notes each time you go through the process so you can learn from past mistakes.

Ready to get your house hunt started? Reach out — We’re happy to help!

Tips on HOW to Purchase an Investment Property

Three of the most commonly used practices for investing in real estate. Each of these have their pros and cons and it’s always best to talk to a lender - credit unions are good place to start for HELCOs!

Ready to get your house hunt started? Reach out — We’re happy to help!

Robert Reffkin, Compass co-founder and CEO, joins ‘Squawk on the Street’ to discuss the data behind Compass’ quarterly earnings results, if there’s been movement in home prices, and more.

There are more buyers than sellers giving clear opportunities for sellers this spring. If you’re wondering if it’s the right time to make a move, we’d love to connect!

A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market. If you’re planning to sell your house this season, here’s what real estate experts are saying you should keep in mind.

Houses that are updated and priced at their current market value are still selling. Jeff Tucker, Senior Economist at Zillow, says:

“. . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer.”

The need to price your house right is so important today because the market has changed so much over the past year. Danielle Hale, Chief Economist at realtor.com, explains:

“With a smaller pool of buyers today and more competition from other homes on the market, homesellers will likely need to adjust their price expectations in the market this spring.”

While this spring housing market is different than last year’s, sellers with proper expectations who lean on a real estate expert for the best advice on pricing their house well are still finding success. And that’s great news if you’re thinking about selling.

As mortgage rates have risen and remain volatile, some buyers have pressed pause on their plans. But there are still plenty of reasons people are buying homes today. Lisa Sturtevant, Chief Economist at Bright MLS, spells out the mindset of today’s buyers:

“For some buyers, higher mortgage rates simply means buying a home is out of the question unless home prices fall. For others, higher mortgage rates will be a hurdle but ultimately will not keep them from getting back into the market after sitting on the sidelines for months.”

That’s why, if you’re interested in selling your house this spring, it’s helpful to work with a real estate agent who can help connect you with those buyers who are ready to purchase a home.

There are still clear opportunities for sellers this spring. If you’re wondering if it’s the right time to make a move, we’d love to connect!

Building Wealth Through Real Estate - Considering Short Term Rentals?

Short-term rentals can be a highly lucrative investment and a fun way to make money. Here are some things to consider before you hang up that “vacancy” sign.

1. Managing short term rentals is not exactly passive income. If you don’t have the time it takes to manage, property managers take 10%-15%.

2. Think beyond vacation rentals. Short term rentals don’t have to be on the beach or a ski slope - think about vicinity to hospitals, business hubs and other area attractions.

3. Do your due diligence when buying an investment property - assess the existing short-term rental market with tools like AirDNA.

4. Treat it like a business - know your ROI.

5. Work with an agent who knows the area. Buying the right property at the right price takes some experience. Remember that the purchase of the property is the bigger investment than the rentals to follow.

Wondering which U.S. destinations are leading the pack in the short-term rental market? According to an analysis of Airbnb and Vrbo data, here are the markets with the highest potential profits:

- Maui, Hawaii - $375 average daily rate

- Kenai Peninsula, Alaska - $262 average daily rate

- Chattanooga, Tennessee - $180 average daily rate

- Gulfport/Biloxi, Mississippi - $196 average daily rate

- Slidell, Louisiana - $339 average daily rate

- Crystal River, Florida - $221 average daily rate

- Joshua Tree, California - $327 average daily rate

Wondering how to get started? Send us a DM — We’re happy to help!

ProSource Feature 2023

January 30th, 2023

We are honored to be included in the 2023 Edition of ProSource Possibilities Home Improvement Catalog. Our Olivenhain kitchen remodel project is featured above, more photos of that project can be found here! We source most of the materials we use in model projects from ProSource North in Vista. Ask for Doug! And if you’re not local you’re in luck, ProSource has store locations nationwide!

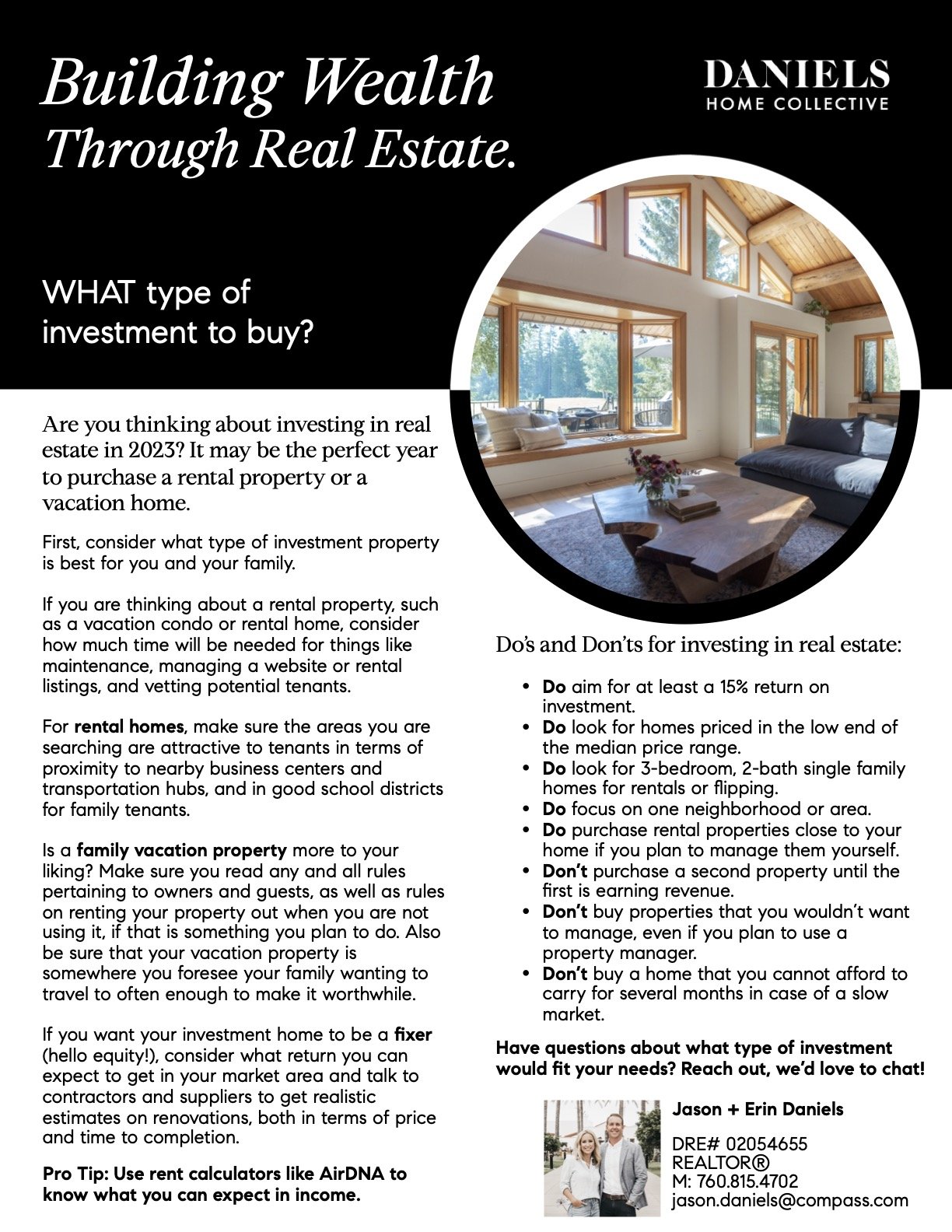

Building Wealth Through Real Estate - WHAT type of investment to buy?

Now that you’re seriously thinking about building wealth through real estate it’s important to determine which type of investment is right for your needs. Sticking close to home will make management of the investment easier, however an out of area investment can also be beneficial. We were looking for a family vacation home that could double as a short term rental and write off for work which is why we decided on Montana.

Researching an area to determine the supply and demand for travel and tourism can be a helpful first step. Glacier National Park welcomes 3 million visitors each year and with minimal housing options, statistics told us it would be a good short term rental. Our next step was to confirm we were buying the right house, in the right area so we turned to AirDNA. AirDNA utilizes rankings, resources, tools, and reports to help pinpoint short term rental opportunities.

Our final thoughts, if you want to see the largest equity gains, looking for an investment property that needs some work has the potential to add $ to your bottomline! More on the later…

We’ll be sharing everything we’ve learned on our journey and when you’re ready to start building wealth through real estate we’re here to answer all of your questions!

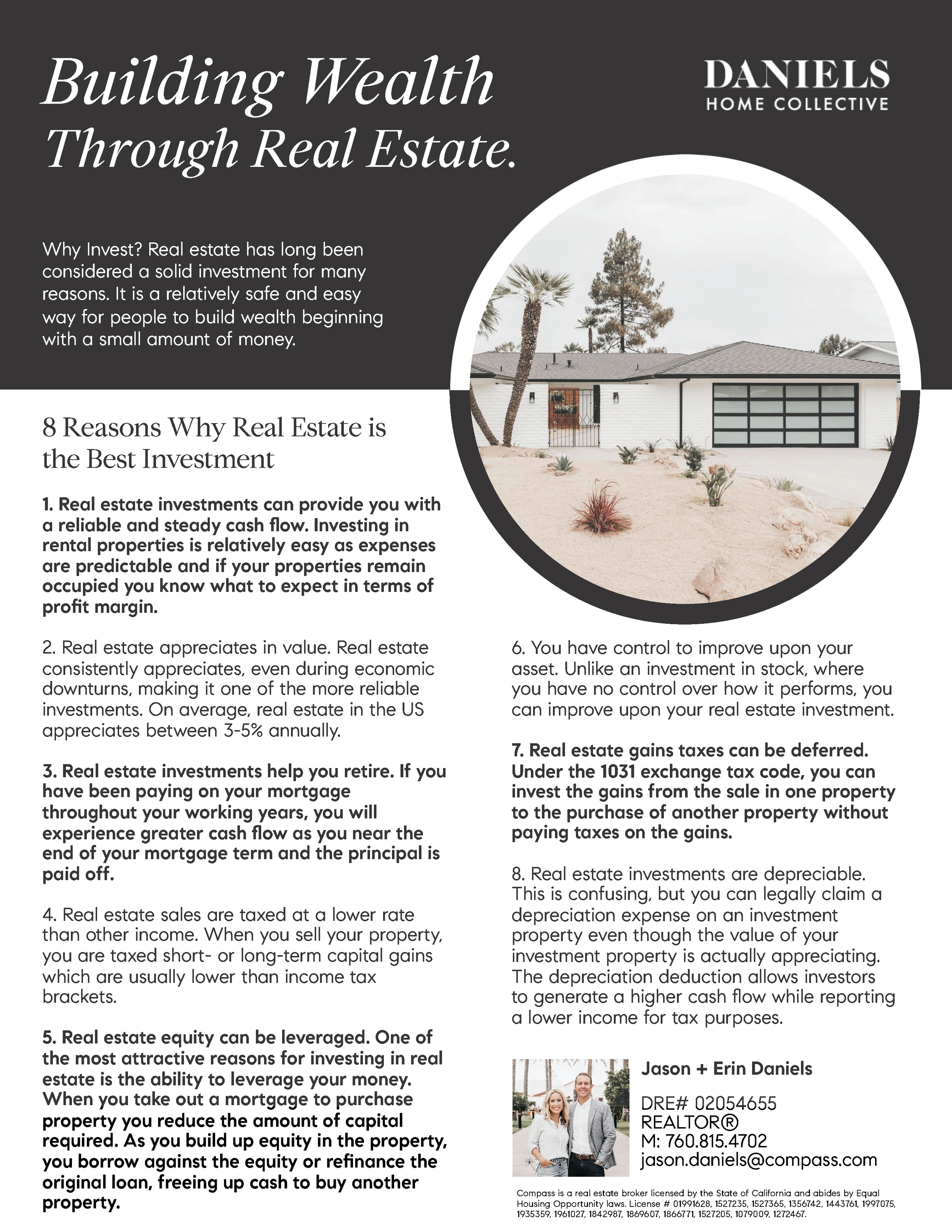

8 Reasons Why Real Estate is the Best Investment

We’re kicking off our Investment Series with WHY it is a good idea to build wealth through real estate. There are many different types of investments out there and a multitude of reasons for why people choose to build wealth through real estate. Jason and I have experience in long term investments with annual tenants, short term investment options like AirBnBs and flipping properties. We’ll be sharing everything we’ve learned along the way and when you’re ready to start building wealth through real estate we’re here to answer all of your questions!

A First Look at Our Montana Bungalow

For links on where to buy everything pictured above click here.

Happy Monday friends! Today we’re featuring the design plan for our Montana Shop Conversion. If you’re new here, we bought and renovated our first short term rental house in Montana last summer. This year we’re converting the 620 sq ft shop into a two bedroom, 1 bath bungalow! A few of the many goals of this project are to host more family, have an additional stream of income and increase property value.

As always, we needed a jumping off point! Needless to say, we are carrying over the moody mountain vibes you saw in our Montana Modern Cabin and adding a few hints of warmth. Because access and timing of materials is a big deal up in North Western Montana we’re using readily available building materials and sourcing vintage furniture pieces where we can!

We have a fun mix of texture happening - rugged concrete tile, smooth Alder doors, quartz soapstone counters, woven light fixtures and even a velvet bed!

We’re sticking with the same moody Railings by Farrow & Ball paint color for the bedroom and bathroom walls, complimented by warm wooden shiplap ceilings. In the common area were sticking to the lighter palette with White Dove by Benjamin Moore.

We’re opting for oversized tile floor throughout, vertical straight stacked tile in the shower and the same moody soapstone counters in the kitchen.

This time around we’re most excited about what the bungalow will have to offer that our main house didn’t, a fireplace, a spa and an undone exterior (which means new siding and windows)! More on all of those features to come! For links to everything you see on our mood board and more, click here!

For more real estate and design tips like these, subscribe to our blog below!

If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market this year. In 2022, the market underwent a major shift as economic uncertainty and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices. But what about 2023?

An article from HousingWire offers this perspective:

“The red-hot housing market of the past 2 ½ years was characterized by sub-three percent mortgage rates, fast-paced bidding wars and record-low inventory. But more recently, market conditions have done an about-face. . . . now is the opportunity for everyone to become re-educated about what a ‘typical’ housing market looks like.”

This year, experts agree we may see the return of greater stability and predictability in the housing market if inflation continues to ease and mortgage rates stabilize. Here’s what they have to say.

The 2023 forecast from the National Association of Realtors (NAR) says:

“While 2022 may be remembered as a year of housing volatility, 2023 likely will become a year of long-lost normalcy returning to the market, . . . mortgage rates are expected to stabilize while home sales and prices moderate after recent highs, . . .”

Danielle Hale, Chief Economist at realtor.com, adds:

“. . . buyers will not face the extreme competition that was commonplace over the past few years.”

Lawrence Yun, Chief Economist at NAR, explains home prices will vary by local area, but will net neutral nationwide as the market continues to adjust:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

Mark Fleming, Chief Economist at First American, says:

“The housing market, once adjusted to the new normal of higher mortgage rates, will benefit from continued strong demographic-driven demand relative to an overall, long-run shortage of supply.”

If you’re looking to buy or sell a home this year, the best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. We’re ready to serve your needs, reach out to learn more!

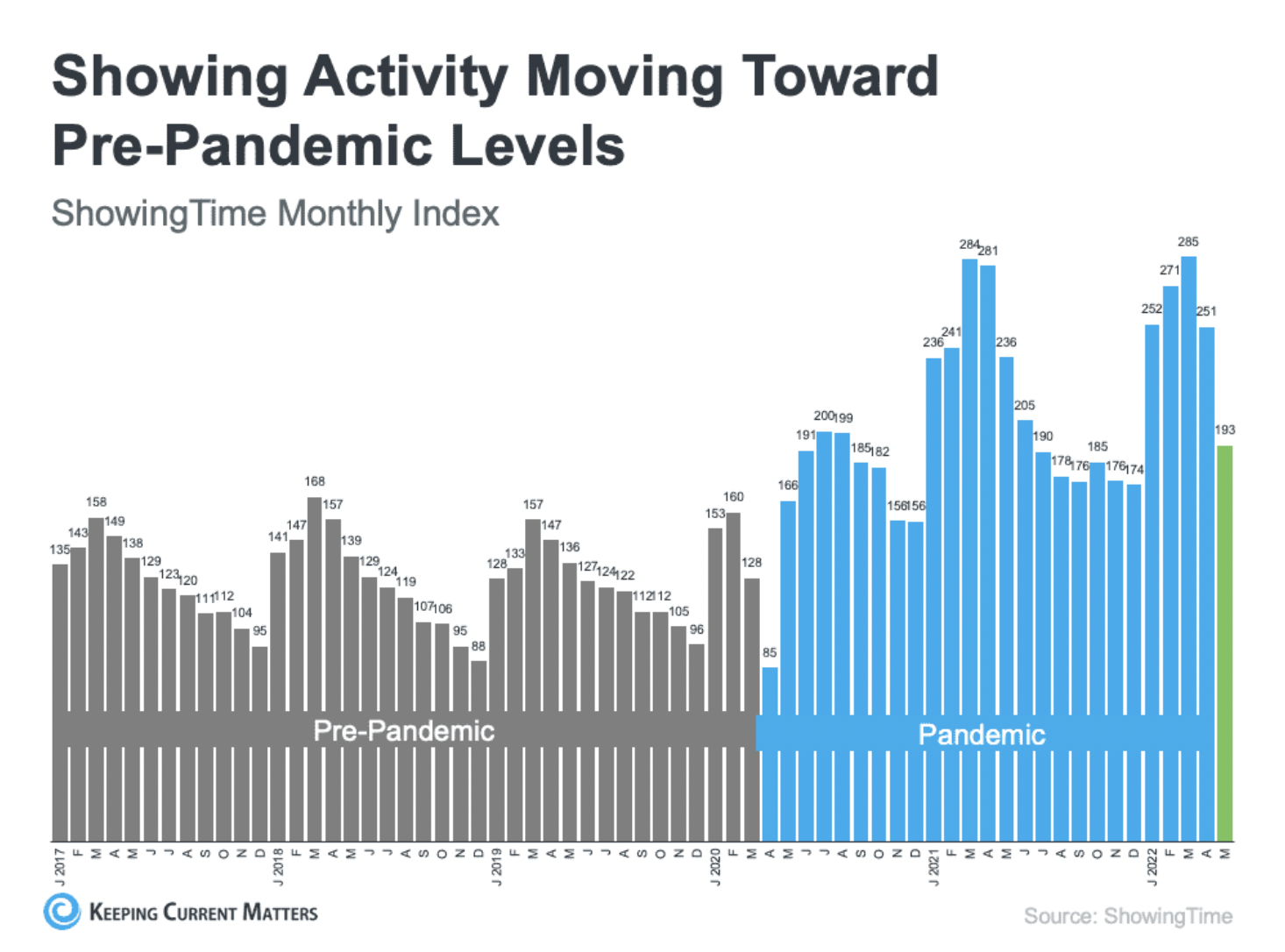

Mortgage rates are much higher today than they were at the beginning of the year, and that’s had a clear impact on the housing market. As a result, the market is seeing a shift back toward the range of pre-pandemic levels for buyer demand and home sales.

But the transition back toward pre-pandemic levels isn’t a bad thing. In fact, the years leading up to the pandemic were some of the best the housing market has seen. That’s why, as the market undergoes this shift, it’s important to compare today not to the abnormal pandemic years, but to the most recent normal years to show how the current housing market is still strong.

The ShowingTime Showing Index tracks the traffic of home showings according to agents and brokers. It’s also a good indication of buyer demand over time. Here’s a look at their data going back to 2017 (see graph below):

Here’s a breakdown of the story this data tells:

The 2017 through early 2020 numbers (shown in gray) give a good baseline of pre-pandemic demand. The steady up and down trends seen in each of these years show typical seasonality in the market.

The blue on the graph represents the pandemic years. The height of those blue bars indicates home showings skyrocketed during the pandemic.

The most recent data (shown in green), indicates buyer demand is moderating back toward more pre-pandemic levels.

This shows that buyer demand is coming down from levels seen over the past two years, and the frenzy in real estate is easing because of higher mortgage rates. For you, that means buying your next home should be less challenging than it would’ve been during the pandemic because there is more inventory available.

As mortgage rates started to rise this year, other shifts began to occur too. One additional example is the slowing pace of home sales. Using data from the National Association of Realtors (NAR), here’s a look at existing home sales going all the way back to 2017. Much like the previous graph, a similar trend emerges (see graph below):

Again, the data paints a picture of the shift:

The pre-pandemic years (shown in gray) establish a baseline of the number of existing home sales in more typical years.

The pandemic years (shown in blue) exceeded the level of sales seen in previous years. That’s largely because low mortgage rates during that time spurred buyer demand and home sales to new heights.

This year (shown in green), the market is feeling the impact of higher mortgage rates and that’s moderating buyer demand (and by extension home sales). That’s why the expectation for home sales this year is closer to what the market saw in 2018-2019.

Both of those factors have opened up a window of opportunity for homeowners looking to move and for buyers looking to purchase a home. As demand moderates and the pace of home sales slows, housing inventory is able to grow – and that gives you more options for your home search.

So don’t let the headlines about the market cooling or moderating scare you. The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic – and that’s a good thing. It opens up new opportunities for you to find a home that meets your needs.

The housing market is undergoing a shift because of higher mortgage rates, but the market is still strong. If you’ve been looking to buy a home over the last couple of years and it felt impossible to do, now may be your opportunity. Buying a home right now isn’t easy, but there is more opportunity for those who are looking.

If you’re thinking of buying or selling a house, you’re at an exciting decision point. And anytime you make a big decision like that, one thing you should always consider is timing. So, what does the rest of the year hold for the housing market? Here’s what experts have to say.

There are early signs housing inventory is starting to grow and experts say that should continue in the months ahead. According to Danielle Hale, Chief Economist at realtor.com:

“The gap between this year’s homes for sale and last year’s is one-fifth the size that it was at the beginning of the year. The catch up is likely to continue, . . . This growth will mean more options for shoppers than they’ve had in a while, even though inventory continues to lag pre-pandemic normal.”

As a buyer, having more options is welcome news. Just remember, housing supply is still low, so be ready to act fast and put in your best offer up front.

As a seller, your house may soon face more competition when other sellers list their homes. But the good news is, if you’re also buying your next home, having more options to choose from should make that move-up process easier.

Experts also agree inflation should continue to drive up mortgage rates, albeit more moderately. Odeta Kushi, Deputy Chief Economist at First American, says:

“… ongoing inflationary pressure remains likely to push mortgage rates even higher in the months to come.”

As a buyer, work with trusted real estate professionals, including your lender, so you can learn how rising mortgage rate environments impact your purchasing power. It may make sense to buy now before it costs more to do so, if you’re ready.

As a seller, rising mortgage rates are motivating some homeowners to make a move up sooner rather than later. If you’re planning to buy your next home, talk to a trusted real estate advisor to decide how to time your move.

Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market. That said, experts agree the pace of that appreciation should moderate – but home prices won’t fall. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Prices throughout the country have surged for the better part of two years, including in the first quarter of 2022. . . Given the extremely low inventory, we’re unlikely to see price declines, but appreciation should slow in the coming months.”

As a buyer, continued home price appreciation means it’ll cost you more to buy the longer you wait. But it also gives you peace of mind that, once you do buy a home, it will likely grow in value. That makes it historically a good investment and a strong hedge against inflation.

As a seller, price appreciation is great news for the value of your home. Again, lean on a professional to strike the right balance of the best conditions possible for both selling your house and buying your next one.

Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Connect us to discuss your goals and what lies ahead, so you can pick your best time to make a move.

Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream.

Prior to the 1950s, less than half of the country owned their own home. However, after World War II, many returning veterans used the benefits afforded by the GI Bill to purchase a home. Since then, the percentage of homeowners throughout the country has increased to the current rate of 65.5%. That strong desire for homeownership has kept home values appreciating ever since. The graph below tracks home price appreciation since the end of World War II:

The graph shows the only time home values dropped significantly was during the housing boom and bust of 2006-2008. If you look at how prices spiked prior to 2006, it looks a bit like the current spike in prices over the past two years. That may lead some people to be concerned we’re about to see a similar fall in home values as we did when the bubble burst. To help alleviate those worries, let’s look at what happened last time and what’s happening today.

Back in 2006, foreclosures flooded the market. That drove down home values dramatically. The two main reasons for the flood of foreclosures were:

Many purchasers were not truly qualified for the mortgage they obtained, which led to more homes turning into foreclosures.

A number of homeowners cashed in the equity on their homes. When prices dropped, they found themselves in an underwater situation (where the home was worth less than the mortgage on the house). Many of these homeowners walked away from their homes, leading to more foreclosures. This lowered neighboring home values even more.

This cycle continued for years.

Here are two reasons today’s market is nothing like the one we experienced 15 years ago.

Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Today, purchasers and those refinancing a home face much higher standards from mortgage companies.

Data from the Urban Institute shows the amount of risk banks were willing to take on then as compared to now.

There’s always risk when a bank loans money. However, leading up to the housing crash 15 years ago, lending institutions took on much greater risks in both the person and the mortgage product offered. That led to mass defaults, foreclosures, and falling prices.

Today, the demand for homeownership is real. It’s generated by a re-evaluation of the importance of home due to a worldwide pandemic. Additionally, lending standards are much stricter in the current lending environment. Purchasers can afford the mortgage they’re taking on, so there’s little concern about possible defaults.

And if you’re worried about the number of people still in forbearance, you should know there’s no risk of that causing an upheaval in the housing market today. There won’t be a flood of foreclosures.

2. People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

As mentioned above, when prices were rapidly escalating in the early 2000s, many thought it would never end. They started to borrow against the equity in their homes to finance new cars, boats, and vacations. When prices started to fall, many of these homeowners were underwater, leading some to abandon their homes. This increased the number of foreclosures.

Homeowners didn’t forget the lessons of the crash as prices skyrocketed over the last few years. Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has more than doubled compared to 2006 ($4.6 trillion to $9.9 trillion).

The latest Homeowner Equity Insights report from CoreLogic reveals that the average homeowner gained $55,300 in home equity over the past year alone. Odeta Kushi, Deputy Chief Economist at First American, reports:

“Homeowners in Q4 2021 had an average of $307,000 in equity – a historic high.”

ATTOM Data Services also reveals that 41.9% of all mortgaged homes have at least 50% equity. These homeowners will not face an underwater situation even if prices dip slightly. Today, homeowners are much more cautious.

The major reason for the housing crash 15 years ago was a tsunami of foreclosures. With much stricter mortgage standards and a historic level of homeowner equity, the fear of massive foreclosures impacting today’s market is not realistic.

A Key To Building Wealth Is Homeownership

The link between financial security and homeownership is especially important today as inflation rises. But many people may not realize just how much owning a home contributes to your overall net worth. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability.”

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter (see visual below):

The results from this report show that owning a home is a key piece to the puzzle when building your overall net worth.

The net worth gap between owners and renters exists in large part because homeowners build equity. As a homeowner, your equity grows as your home appreciates in value and you make your mortgage payments each month.

In other words, when you own your home, you have the benefit of your mortgage payment acting as a contribution to a forced savings account. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

To sum it up, NAR says it simply:

“Homeownership has always been an important way to build wealth.”

The gap between a homeowner’s net worth and a renter’s shows how truly foundational homeownership is to wealth-building. If you’re ready to start on your journey to homeownership, let’s talk today!

Jugador Hill Exterior

Our Jugador Hill home needed some serious vision everywhere you looked, including the exterior! When we purchased the home it felt like a fortress! Our vision was for a light & airy, welcoming exterior that started with removing the 6’ cinder block wall and security gate at the front door.

From there we dove into the hardscape and entrance. Two big ticket items we wanted to change from the beginning, the roof and driveway, ended up not being financially feasible so we took those into consideration in the design process. You could basically drive your car up to the front door and that needed to change! We settled for removing a panel and a half of concrete and created a new approach with oversized poured concrete pavers and a new front porch.

From there it was all about making the tan concrete and brown roof work with our new vision for the front. We chose oversized Arterra Golden White porcelain pavers for the large walkup/porch area that had a nice mix of warm and cool tones. The warmer tones tied in the existing driveway and the cooler tones opened the door for us to incorporate some softer blues, greens and grays with the landscaping! For a more modern feel, we chose an oversized 6“ minus stone in Fossil Gray to line the walkup and complimented it with a mix of evergreen shrubbery (because they don’t go dormant), blue green succulents and a few olive trees.

Meanwhile we honed in on the perfect warm white for our exterior paint, Benjamin Moore, White Dove! We decided to paint the entire house, including the trim, eves and garage doors in the same color. Our thin framed black windows complimented the white exterior and to tie in the roof, we decided to splurge on copper gutters for the front of the house.

The final touches included some new exterior lighting, we went timeless with these more traditional rectangle wall sconces. A new stained black front door brought some depth to the space and this Article Sofa is a nice spot to watch the kids shoot some hoops. Our finishing touch was the 2x6 Doug Fir modern accent fence we added, this brought an entire new dimension to the space and we love the way it turned out! Our favorite part about this transformation, being able to built and entire vision that we love around a driveway and roof we hated originally! Check out our finished product below!

4 Ways Homeowners Can Use Their Equity

Your equity is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

If you’re looking for the best ways to use your growing equity, here are four options:

If you’re finding you no longer have the space you need, it might be time to move into a larger home. Or, it’s possible you have too much space and would like something smaller. No matter the situation, consider using your equity to power a move into a home that fits your changing lifestyle. Moving into a larger home can provide extra space for remote work or loved ones. Downsizing, on the other hand, may mean saving time and money by caring for a smaller home.

If the size of your home isn’t a challenge but your current location is, it could be time to relocate to a new area. Maybe you enjoy vacationing in the mountains, at the beach, or another area, and you’re dreaming of living there year-round. Or perhaps the distance between you and your loved ones is greater than you’d like, and you want to close the gap. No matter what, your home equity can fuel your move to the location where you really want to live.

If you’re not ready to move into a new home, you can use your equity to invest in a new business venture. As the U.S. Small Business Administration Office of Advocacy says:

“There is an estimate of 31.7 million small business owners in the United States, many of them started their business with the equity they had in their home.”

While it’s not recommended that homeowners use their equity for unnecessary spending, leveraging your equity to start a business that you’re passionate about can potentially grow your nest egg further.

Whether you have a loved one preparing to head off to college or you’re planning to go back to school yourself, the thought of paying for higher education can be daunting. In either situation, using a portion of your growing equity can help with those costs, so you can make an investment in someone’s future.

Your equity can help you achieve your goals. If you’re unsure how much equity you have in your home, connect with us so you can start planning your next move!

What Does the Future Hold for Home Prices?

If you’re looking to buy or sell a house, chances are you’ve heard talk about today’s rising home prices. And while this increase in home values is great news for sellers, you may be wondering what the future holds. Will prices continue to rise with time, or should you expect them to fall?

To answer that question, let’s first understand a few terms you may be hearing right now.

Appreciation is an increase in the value of an asset.

Depreciation is a decrease in the value of an asset.

Deceleration is when something happens at a slower pace.

It’s important to note home prices have increased, or appreciated, for 114 straight months. To find out if that trend may continue, look to the experts. Pulsenomics surveyed over 100 economists, investment strategists, and housing market analysts asking for their five-year projections. In terms of what lies ahead, experts say the market may see some slight deceleration, but not depreciation.

Here’s the forecast for the next few years:

As the graph above shows, prices are expected to continue to rise, just not at the same pace we’ve seen over the last year. Over 100 experts agree, there is no expectation for price depreciation. As the arrows indicate, each number is an increase, which means prices will rise each year.

Bill McBride, author of the blog Calculated Risk, also expects deceleration, but not depreciation:

“My sense is the Case-Shiller National annual growth rate of 19.7% is probably close to a peak, and that year-over-year price increases will slow later this year.”

A recent article from realtor.com indicates you should expect:

“. . . annual price increases will slow to a more normal level, . . .”

What experts are projecting for the years ahead is more in line with the historical norm for appreciation. According to data from Black Knight, the average annual appreciation from 1995-2020 is 4.1%. As you can see from the chart above, the expert forecasts are closer to that pace, which means you should see appreciation at a level that’s aligned with a more normal year.

If you’re a buyer, don’t expect a sudden or drastic drop in home prices – experts say it won’t happen. Instead, think about your homeownership goals and consider purchasing a home before prices rise further.

If you’re a seller, the continued home price appreciation is good news for the value of your house. Work with an agent to list your house for the right price based on market conditions.

Experts expect price deceleration, not price depreciation over the coming years. Reach out discuss what’s happening in the housing market today, where things are headed, and what it means for you.

Is It Time To Move on to a New Home?

If you’ve been in your home for longer than five years, you’re not alone. According to recent data from First American, homeowners are staying put much longer than historical averages (see graph below):

As the graph shows, before 2008, homeowners sold their houses after an average of just five years. Today, that number has more than doubled to over 10 years. The housing industry refers to this as your tenure.

To really explore tenure, it’s important to understand what drives people to make a move. An article from The Balance explores some of the primary reasons individuals choose to sell their houses. It says:

“People who move for home-related reasons might need a larger home or a house that better fits their needs, . . . Financial reasons for moving include wanting a nicer home, moving to a newer home to avoid making repairs on the old one, or cashing in on existing equity.”

If you’ve been in your home for longer than the norm, chances are you’re putting off addressing one, if not several, of the reasons other individuals choose to move. If this sounds like you, here are a few things to consider:

As the past year has shown, our needs can change rapidly. That means the longer you’ve been in your home, the more likely it is your needs have evolved. The Balance notes several personal factors that could lead to your home no longer meeting your needs, including relationship and job changes.

For example, many workers recently found out they’ll be working remotely indefinitely. If that’s the case for you, you may need more space for a dedicated home office. Other homeowners choose to sell because the number of people living under their roof changes. Now more than ever, we’re spending more and more time at home. As you do, consider if your home really delivers on what you need moving forward.

One of the biggest benefits of homeownership is the equity your home builds over time. If you’ve been in your house for several years, you may not realize how much equity you have. According to the latest Homeowner Equity Report from CoreLogic, homeowners gained an average of $33,400 in equity over the past year.

That equity, plus today’s low mortgage rates, can fuel a major upgrade when you sell your home and purchase a new one. Or, if you’re looking to downsize, your equity can help provide a larger down payment and lower your monthly payments over the life of your next loan. No matter what, there are significant financial benefits to selling in today’s market.

If you’ve been in your home for 5-10 years or more, now might be the time to explore your options. Today’s low rates and your built-up equity could provide you with the opportunity to address your evolving needs. Reach out today if you feel it’s time to discuss selling.

Is Homeownership Still Considered Part of the American Dream?

Since the birth of our nation, homeownership has always been considered a major piece of the American Dream. As Frederick Peters reports in Forbes:

“The idea of a place of one’s own drives the American story. We became a nation out of a desire to slip the bonds of Europe, which was still in many respects a collection of feudal societies. Old rich families, or the church, owned all the land and, with few exceptions, everyone else was a tenant. The magic of America lay not only in its sense of opportunity, but also in the belief that life could in every way be shaped by the individual. People traveled here not just for religious freedom, but because in America anything seemed possible.”

Additionally, a research paper released just prior to the shelter-in-place orders issued last year concludes:

“Homeownership is undeniably the cornerstone of the American Dream, and is inseparable from our national ethos that, through hard work, every American should have opportunities for prosperity and success. It is the stability and wealth creation that homeownership provides that represents the primary mechanism through which many American families are able to achieve upward socioeconomic mobility and greater opportunities for their children.”

Definitely not. A survey of prospective homebuyers released by realtor.com last week reveals that becoming a homeowner is still the main reason this year’s first-time homebuyers want to purchase a home. When asked why they want to buy, three of the top four responses center on the financial benefits of owning a home. The top four reasons for buying are:

59% – “I want to be a homeowner”

33% – “I want to live in a space that I can invest in improving”

31% – “I need more space”

22% – “I want to build equity”

The survey also reports that 62% of millennials say a desire to be a homeowner is the main reason they’re buying a home. This contradicts the thinking of some experts who had believed millennials were going to be the first “renter generation” in our nation’s history.

While reporting on the survey, George Ratiu, Senior Economist at realtor.com, said:

“Americans, even millennials who many thought would never buy, have a strong preference for homeownership for the same reasons many generations before them have — to invest in a place of their own and in their communities, and to build a solid financial foundation for themselves and their families.”

Odeta Kushi, Deputy Chief Economist for First American, also addresses millennial homeownership:

“Millennials have delayed marriage and having children in favor of investing in education, pushing marriage and family formation to their early-to-mid thirties, compared with previous generations, who primarily made these lifestyle choices in their twenties…Delayed lifestyle choices delay the desire for homeownership.”

Kushi goes on to explain:

“As more millennials get married and form families, millennials remain poised to transform the housing market. In fact, the housing market is already experiencing the earliest gusts of the tailwind.”

As it always has been and very likely always will be, homeownership continues to be a major component in every generation’s pursuit of the American Dream. Ready to make homeownership a reality - we’d love to be of service!

How Much Leverage Do Today’s House Sellers Have?

The housing market has been scorching hot over the last twelve months. Buyers and their high demand have far outnumbered sellers and a short supply of houses. According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), sales are up 23.7% from the same time last year while the inventory of homes available for sale is down 25.7%. There are 360,000 fewer single-family homes for sale today than there were at this time last year. This increase in demand coupled with such limited supply is leading to more bidding wars throughout the country.

Rose Quint, Assistant Vice President for Survey Research with the National Association of Home Builders (NAHB), recently reported:

“The number one reason long-time searchers haven’t made a home purchase is not because of their inability to find an affordably-priced home, but because they continue to get outbid by other offers.”

A survey in the NAHB report showed that 40% of buyers have been outbid for a home they wanted to purchase. This is more than twice the percentage in 2019, which was 19%.

It means sellers have tremendous leverage when negotiating with buyers.

In negotiations, leverage is the power that one side may have to influence the other side while moving closer to their negotiating position. A party’s leverage is based on its ability to award benefits or eliminate costs on the other side.

In today’s market, a buyer wants three things:

To buy a home

To buy now before prices continue to appreciate

To buy now and take advantage of historically low mortgage rates while they last

These three buyer needs give the homeowner tremendous leverage when selling their house. Most realize this leverage enables the seller to sell at a good price. However, there may be another need the seller has that can be satisfied by using this leverage.

Odeta Kushi, Deputy Chief Economist at First American, recently identified a situation in which many sellers are finding themselves today:

“As mortgage rates are expected to remain near 3%, millennials continue to form households and more existing homeowners tap their equity for the purchase of a better home…Many homeowners may want to upgrade, but do not for fear that they will be unable to find a home to buy.”

“While the fear of not being able to find something to buy will not disappear in a limited supply environment, new housing supply can incentivize existing homeowners to move.”

There’s no doubt many sellers would love to build a new home to perfectly fit their changing wants and needs. However, most builders require that they sell their house first. If the seller sells their home, where would they live while their new home is being constructed?

As mentioned, buyers have compelling reasons to purchase a home now, and many homeowners have challenges to address if they want to sell. Perhaps they can make a deal to satisfy each party’s needs. But how?

The seller may decide to sell their home to the buyer at today’s price, which will enable the purchaser to take advantage of current mortgage rates. In return, the buyer might lease the house back to the seller for a pre-determined length of time while the seller’s new home is being built. A true win-win negotiation.

Not every buyer will agree to such a deal – but you only need one.

That’s just one example of how a seller might be able to overcome a challenge because of the leverage they have in today’s market. Maybe you feel a need to make certain repairs before selling. Perhaps you need time to get permits or approvals for certain upgrades you made to the house. Whatever the challenge, you may be able to work it out.

If you’re considering selling your house now but worry a huge obstacle stands in your way, contact us we’d love to be of service. Maybe with the leverage you currently have, you can negotiate a deal that will allow you to make the move of your dreams.

2021 Real Estate Market Outlook

The housing market was a shining star in 2020, fueling the economic turnaround throughout the country. As we look forward to 2021, can we expect real estate to continue showing such promise? Here’s what experts have to say about the year ahead.

Lawrence Yun, Chief Economist, National Association of Realtors (NAR)

“In 2021, I think rates will be similar or modestly higher, maybe 3%…So, mortgage rates will continue to be historically favorable.”

Danielle Hale, Chief Economist, realtor.com

“We expect sales to grow 7 percent and prices to rise another 5.7 percent on top of 2020’s already high levels.”

Mark Fleming, Chief Economist, First American

“Mortgage rates are expected to remain low for the foreseeable future and millennials will continue forming households, keeping demand robust, even if income growth moderates. Despite the best intentions of home builders to provide more housing supply, the big short in housing supply will continue into 2021 and likely keep house price appreciation flying high.”

Bottom line, whether you’re looking to buy or sell this year we would be happy to help you learn more about your options!

Studio McGee x Target Spring 2021 Collaboration

Studio McGee x Target Spring 2021 is here! Just a few of our faves you can shop here.

Some tips for getting your hands on these goodies… They seem to be rolling out in phases, so mark your calendars for their release dates at midnight PST to shop, hit that notify me button if something is already sold out (add to cart + checkout the second you get that back in stock email) or be like us and just check back hourly to see if/when they release their patio furniture to masses online!

Our Go To White Paint Colors

What’s your favorite white paint? This is the #1 question we get asked. There are hundreds of white paint colors and it can be overwhelming to narrow one down. The first step is to determine whether a space needs a warm or cool white.

For the interior of our #jugadorhill home and San Julian home we wanted a bright, crisp white without blue undertones and Dunn Edwards Cool December delivered!

For the exterior of our #jugadorhill home we knew we needed a warmer white that was more traditional, Benjamin Moore’s White Dove was the perfect pick!

If you’re looking for just a touch of warmth, Sherwin Williams Pure White is for you! And lastly we love Benjamin Moore’s Simply White for its versatility and warmth (it has a slight yellow undertone) - look how nicely it complimented our La Casa remodel!

Once you have a few colors narrowed down we like to order samples from www.samplize.com so you can try the color on in multiple rooms during different times of day with one convenient peel-and-stick sample. Happy painting!

4 Reasons People Are Buying Homes in 2021

According to many experts, the real estate market is expected to continue growing in 2021, and it’s largely driven by the lasting impact the pandemic is having on our lifestyles. As many of us spend extra time at home, we’re reevaluating what “home” means and what we may need in one going forward.

Here are 4 reasons people are reconsidering where they live and why they’re expecting to buy a home this year.

In 2020, the average interest rate for a 30-year fixed mortgage hit a record low 16 times, continuing to fall further below 3%. According to Freddie Mac, the average 30-year fixed interest rate today is 2.65%. Many wonder how low these rates will go and how long they’ll last. Len Keifer, Deputy Chief Economistfor Freddie Mac, advises:

“If you’ve found a home that fits your needs at a price you can afford, it might be better to act now rather than wait for future rate declines that may never come and a future that likely holds very tight inventory.”

This sense of urgency is driving many to buy this year.

Remote work is a new normal for many businesses, and it’s lasting longer than most expected. Many in the workforce today are discovering they don’t need to live close to the office anymore and they can get more for their money by moving a little further outside of the city limits. David Mele, President at Homes.com, says:

“The surge in the work-from-home population has rewritten the playbook for many homebuying and rental decisions, from when and where to relocate, to what people are looking for in their next residence.”

The reality is, for some people, working remotely in their current home is challenging, especially when there may be other options available.

Another new priority for homeowners is having more usable outdoor space. Being at home is driving those in some areas to seek less densely populated neighborhoods so they have more room to stretch their legs. In addition, those living in apartments and townhomes are often looking for extra square footage, both inside and out.

According to the State of Home Spending report by HomeAdvisor, of the households surveyed, almost half reported spending 27% more on outdoor living over the past year. This is a trend that’s expected to grow in 2021 and beyond.

It’s recently come to light that many homeowners would also rather buy a new home than go through the process of fixing up the one they have. According to the 2020 Profile of Home Buyers and Sellers report from the National Association of Realtors (NAR), 44% of homebuyers purchased a new home to “avoid renovations or problems with the plumbing or electricity.”

Depending on what needs to be addressed, today’s high buyer demand may make it possible to skip some renovations before selling. Many of these homeowners have prioritized buying over renovating for convenience and potential cost savings.

It’s clear that homeownership needs are changing. As a result, Americans are expected to move in record numbers this year. If you’re trying to decide if now is the right time to buy a home, we’d be happy to help you discuss your options!

Our 2021 To-Do List (check out the last one - ekkk!)

Happy New Year friends! We may be a couple weeks into 2021 but let’s face it, we think we all needed a bit of a slower start after 2020! Jason and I have been dreaming up some big things for the new year and we wanted to share our list of projects we’re aiming to achieve. In no particular order here there are below:

1. Laundry room

Now while we wouldn’t call our laundry area a “room” per se we are treating it like one when it comes to design. This area has been a sore spot for us because there is zero storage there now and it’s also located right outside our daughters room. As someone put it, it feels like the entrance to the maids quarters - haha! We will be giving this area a small face lift with storage, functionality and style! This space from Becki Owens is our inspiration!

2. The next item on our to-do list are small lingering projects from 2020. This includes finally installing hardwood floors throughout the house! We so excited for the transformation this will give our home but not looking forward to the install. As far as order of projects go, we usually tell our clients to at least get flooring and paint done before you move in to your home and well, we should have listened to our own advice - haha! We will have to move out and remove everything from our house for a week while the floors get installed which is why the flooring we purchased has been sitting in storage since September. This will happen soon though!

Another lingering project are the kids bathrooms. Their vanities are being built as we speak! The end result will hopefully evoke the same feeling you get from these inspiration photos below!

3. Another big ticket item that Jason and I hope to-do this year is purchase an investment property! Having owned multiple investment properties in his 20’s, Jason is well seasoned in this realm. We are not sure what exactly this will entail - whether it’s a flip here in Southern California, a vacation home out of state (in the mountains is my dream!) or a short/long term rental property outside of California - time will tell. We’re taking into consideration what makes the most financial and logistical sense and staying open to all opportunities!

4. Granny Flat

Speaking of investment property, we’ve been throwing around the idea of converting our second garage into a granny flat! Well, this is more of my goal ;) but Jason has given me the green light to submit plans to the county and I’ll be doing this all on my own! Now, we don’t see us actually building out the space in 2021 but if we can get plans drawn and approved, we’ll take it! There’s a few thoughts behind this addition to our home: a place for extended family to stay, an opportunity to create some extra income and/or a nice quiet space for working, exercise etc… This will be a fully functional 400 sq ft studio space with a bathroom and kitchenette! Our inspiration is Studio McGee’s latest Netflix remodel pictured here! Can’t wait to take you all along for the ride!

5. Next on the list is sharing more lifestyle stuff with you all! A new component we’re excited to offer our community are tips for creating not just beautiful, functional spaces but also healthy & happy homes. Health & Wellness has been big journey for us over the last 10 years, we’ve learned a lot along the way and we want to share all of that knowledge with you! If you’ve been around for awhile you may have heard us talk about some of these topics so we’ll also be exploring new topics like technology, gut health, whole living etc… If there’s anything you’re interested in learning more about let us know!

6. a garden

Now this has been a new year’s resolution, a birthday present, even a Christmas present for years and has yet to happen - haha! But this is the year! We want to be more sustainable, healthy and more self sufficient. We have the perfect location for a few garden boxes and we even want to get a lettuce tower like the one pictured here! Of course we’re pinning how to make the garden “cute” too! Now, we have zero experience in this realm and honestly not much bandwidth to figure it out ourselves so we’ll be bringing in an expert if you know anyone!

7. And we’ve saved the most exciting to-do for last, we’ll be traveling for a project this year to… MONTANA! We are so excited to be partnering with Park Place Hospitality while they renovate a 32 room Inn in Columbia Falls, Montana! The property is located on the west entrance of Glacier National Park and about 30 minutes south east of revered White Fish, Montana. I can not wait to share the concept behind the hotel and how we’ll be dividing and conquering the design to completely transform this Super 8 hotel! Here’s a sneak peek of what we’re proposing for the space!

Now we still have a few other small to-dos for #jugadorhill that aren’t listed here, as well as some family goals, but we’re dying to know… which project are you most excited about for us and for you!

Xx,

December 15th, 2020

The Holidays Aren't Stopping Home Buyers This Year

Black Friday and Cyber Monday are behind us, yet finding the perfect holiday gifts for friends and family is certainly still top of mind for many right now. This year, there’s another type of buyer that’s very active this holiday season – the homebuyer.

Each month, ShowingTime releases their Showing Index which tracks the average number of appointments received on active U.S. house listings. The most recent index notes:

“The Showing Index reported a 60.9 percent jump in nationwide showing traffic year over year in October, the sixth consecutive month to see an increase over last year.”

Here’s the breakdown of the latest activity by region of the country compared to this time last year:

The Northeast increased by 65.5%

The West increased by 64.7%

The Midwest increased by 55.7%

The South increased by 54.7%

The health crisis definitely put homebuying plans on pause for many earlier this year. Buyers, however, are in the market and making moves well past the typical busy homebuying seasons of spring and summer.

One of the main reasons buyer traffic has continued to soar in the second half of 2020 is how dramatically mortgage rates have fallen. According to Freddie Mac, the average mortgage rate last December was 3.72%. Today, the rate is a full percentage point lower.

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter. If you’re thinking of selling your house in 2021, you don’t need to wait until the spring to do it. Your potential buyer is very likely searching for a home in your neighborhood right now. Reach out we’d love to be of service to your family!

November 10th, 2020

Homeownership Is a Key to Building Wealth

For years, real estate has been considered the best investment you can make. A major reason for this is due to the net worth a household gains through homeownership. In fact, according to the 2019 Survey of Consumer Finance Data from the Federal Reserve, for the average homeowner:

“…a primary home accounts for 90% of the total wealth of a family in the U.S.”

Most large purchases, like cars and appliances, depreciate in value as they age, so it’s understandable to question how owning a home can increase wealth over time. In a simple equation, the National Association of Realtors (NAR) explains how the combination of paying your mortgage and home price appreciation grow overall wealth:

Principal Payments + Price Appreciation Gains = Housing Wealth Gain

As home values increase and you make payments toward your home loan, you’ll gain wealth through equity. The same article from NAR also addresses how wealth gains tend to play out over time:

“Housing wealth accumulation takes time and is built up by paying off the mortgage debt and by price appreciation. And while home prices can fall, home prices tend to recover and go up over the longer term. As of September 2020, the median sales price of existing home sales was $311,800, a 35% gain since July 2006 when prices peaked at $230,000.”

Taking a look at how equity has grown for the typical homeowner, it’s clear to see how real estate is a sound long-term investment. NAR notes:

“Nationally, a person who purchased a typical home 30 years ago would have typically gained about $283,000 as of the second quarter of 2020.” (See graph below):

Bottom Line

Whether you’re a current homeowner planning to put your equity toward a new home or have hopes of buying your first home soon, homeownership will always be a great opportunity to build your net worth and overall wealth. Owning a home is truly an investment in your financial future.

For more real estate and design tips like these subscribe to our blog below!

October 23rd, 2020

Why selling your house right now is the right move:

Demand from homebuyers has skyrocketed this year, which means today’s sellers are poised to win big. This ideal moment in time to sell your house won’t last forever, though.

With more sellers coming to the market in the spring, waiting until next year means buyers will have more choices, so your home may not stand out from the crowd.

If you’re interested in taking advantage of this seller’s market, reach out, we’d love to discuss why now may be the right time to make a move on your terms.

For more real estate and design tips like these, subscribe to our blog below!

*Information adapted from www.keepingcurrentmatters.com

September 30th, 2020

HOW WILL THE 2020 ELECTION AFFECT REAL ESTATE?

Whether we’re ready for it or not, the 2020 presidential election is right around the corner.

As if this year hasn’t brought enough uncertainty, an election could be causing your clients to question their buying and selling plans…again.

Rocky political environments can create instability in the stock market-causing consumer confidence to drop. But the real estate market isn’t rocky…it’s rock solid. And delaying plans could mean your clients missing out on once-in-a-lifetime affordability.

To get to the heart of this, it’s important to understand how the history of past presidential elections combined with today’s market factors might play out in real estate this time around.

Here’s what we know…

Historically speaking, home sales typically slow down in the fall following the spring and summer rush. BTIG, a research and analysis company, looked at new home sales from 1963-2019 and noted an average decline of -9.8% in November compared to October.

In that same report, they noticed that this decline becomes slightly more exaggerated in presidential election years, dropping as much as -15% from October to November.

So, why the decline? BTIG attributes it mostly to do with buyers and sellers just becoming more cautious during that time.

They go on to explain, “This caution is temporary, and ultimately results in deferred sales, as the economy, jobs, interest rates and consumer confidence all have far more meaningful roles in the home purchase decision than a Presidential election result in the months that follow.”

Considering the current state of real estate across the country, we can anticipate that while a slow down may occur, its effects will only be temporary. Home sales have remained strong throughout the last couple of winters, and the competitive nature of today’s current market suggests this year should be no different.

While presidential election years may cause consumer weariness, another study looked at how the housing market performs after too.

Meyers Research and Zonda, a leading real estate research firm, found additional data that the year following an election can be the best of the presidential term for home sales.

According to their findings: